GST Return F5 Form Filing Services for Singapore

GST-registered businesses are required to file their GST F5 Form and make GST payment on time to Inland Revenue Authority of Singapore; IRAS.

GST Filing Services

Bookkeeping Services Singapore supports the calculation of the business input and output taxes and filing for the entity’s GST return online.

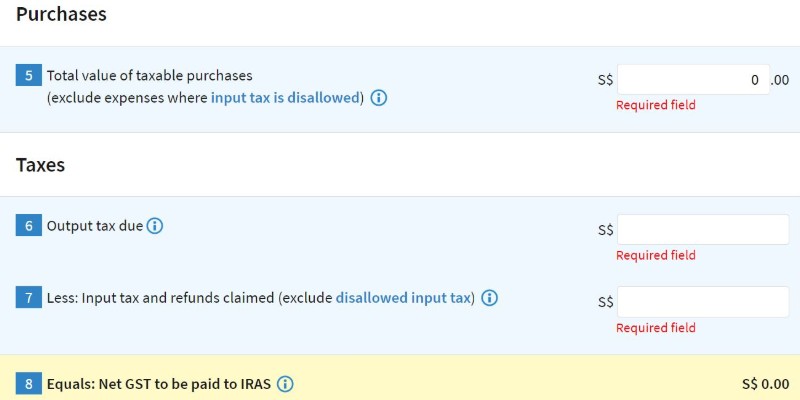

After completed two e-Learning in IRAS website, the GST-registered business should be well versed in filling up the Box 1 to Box 14 of the GST F5 Form. Before that, the GST-registered business must ensure that their business input and output taxes are properly calculated. Some businesses might be using spreadsheet to do their GST computation, but we prefer accounting software. This cloud accounting software is capable of capturing the taxes if we entered both the Account Payable and Account Receivable correctly. We also screen through the suppliers to check if they are GST-registered businesses or not. By collaborating both information, we should be able to get the GST Summary Report right every quarter. We might also run a special report to check if there are transactions that have been edited or changed after the GST period has been filed. Our customers do not have to worry about the impact on their filed GST amount even if there is any customer return or PO cancellation. Every figure for the Box 1 to Box 14 of the GST F5 Form can be traced and identified in our report so that the F5 form can be submitted with 100 percent accuracy.

For GST filing purposes, the customer has to login into IRAS website using their CorpPass and assign the e-Services ‘GST(Filing and Application)’ to us as the ‘Preparer’. For the customers who are not sure, please be assured that we will guide them step by step. Contact us now to get a quotation for our GST Return F5 Filing Service today.

Information related to GST

What is GST?

Goods and Services Tax or GST is a tax collection by the Singapore government on most of the goods and services that buy and sell in Singapore, other than the exemptions.

Who are involved?

Every GST-registered businesses and people who import goods and pays the customs duties in Singapore. Naturally the taxpayers.

How do we know if they are GST-registered businesses?

You may check them under the following government website. It must use the exact Business Name or Tax Ref No. (UEN/ GST Reg No./ NRIC)

https://mytax.iras.gov.sg/ESVWeb/default.aspx?target=GSTListingSearch

Can Non-GST registered businesses charging or claiming GST?

No, unless they fall under exceptions to the rule where a third party that sells or rents out a GST-registered business’ asset in satisfaction of the debt owed or specific industries that are given concessions in conditions by the Minister to claim the GST incurred.

Why GST is important to your business?

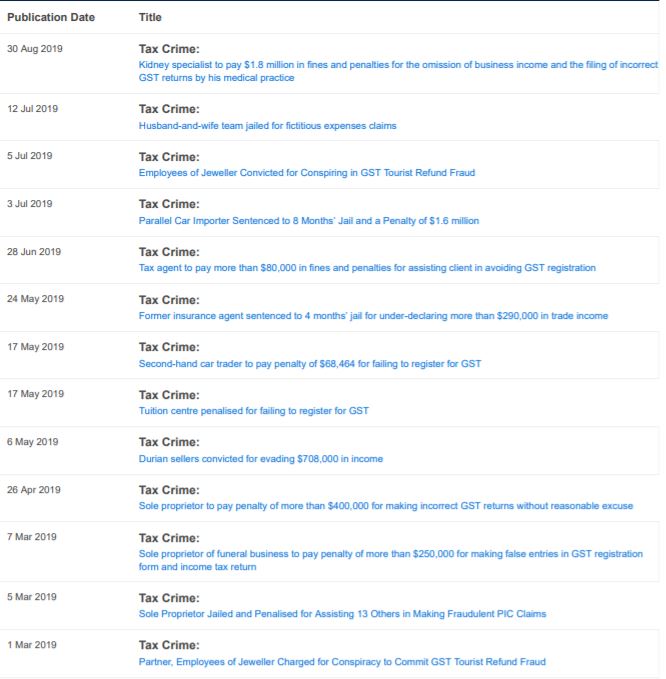

IRAS is strongly committed to deterring, detecting and dealing with tax evasion and fraud, which is a criminal offense and punishable under the law. Goods and Services Tax is also one of them. For the example below, there are seven cases of GST evasion and fraud recorded within the 8 months in 2019. Fine was as high as $400,000. Fine and jail term cause severe disruption to any businesses.

Disclamation: the above GST information is merely brief points curated from the IRAS website as a quick study. For the latest detailed information, please refer to IRAS website.