Accounting Services Singapore

ABOTS LLP works with our accounting associates to provide accounting services like financial statement compilation, corporate income tax computation, Estimate Chargeable Income preparation and support filing to IRAS.

Accounting information for Start-up or businesses and entities doing their first Financial Year End.

Financial Statement Compilation

Both unaudited and audited financial statements will be prepared by an accountant, but the differences are mentioned below. Businesses should know which one is required when they registered with ACRA.

|

Unaudited No audit required No auditor name require in company profile Company Director signed the financial statement |

Audited Audit conducted by *3rd Party Auditor name require in company profile Auditor signed the financial statement |

*3rd Party means both parties, the bookkeeper and auditor, must be independent of each other. There is always a conflict of interest if your bookkeeper works in the same company as your auditor for the same accounting book. To follow the local regulations, we refer out this audited financial statement to an external audit firm.

Corporate Income Tax Preparation

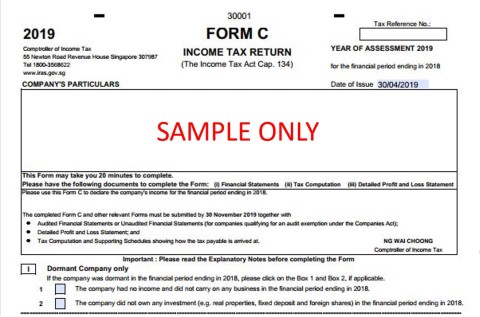

# Sample only. You may download the latest full form from IRAS website.

Computing corporate income tax can be complicated, as the accountant has to determine the business or entity’s chargeable income, which may not be the same as the net profit/loss shown in the income statement. This is due to not all income is taxable nor expenses are deductible for tax purposes. Based on the local tax rates, corporate income tax rebates, and tax exemption schemes for both local and foreign companies, the accountant prepares a Form C/Form C-S with the relevant schedules and then online submission to IRAS; Inland Revenue Authority of Singapore.

Accounting Audit Service

An accounting audit is a process to examine the accounting and financial records of a business or entity to determine if they conform to the local regulations and Singapore Financial Reporting Standard. This auditor is a Certified Public Accountant (CPA) qualified under Chartered Accountant of Singapore CA (Singapore), Institute of Singapore Chartered Accountants ISCA or Association of Chartered Certified Accountants ACCA as a member. The accounting audit outcome will help the CPA to generate the audited financial statement and other reports.

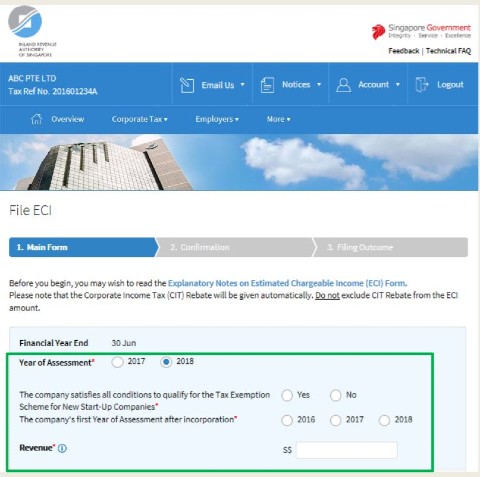

Estimated Chargeable Income Preparation

ECI Estimated Chargeable Income supports cash flow in the sense that your corporate tax for the current year assessment is being paid in advance by installment basis, instead of paying a big lump sum after the end of the current assessment year. The accountant derives the estimated tax based on the previous year’s assessment but preferred the last. Since it is an estimation, the business or entity will have to top up or get a refund by the difference against the actual tax payable when the assessment is done.